Today marks almost twenty-one (21) months since my BOLD decision to resign from my corporate job and channel my energy towards pursuing my passion (s). To say it’s been an adventure will be putting it mildly because I’ve had the most life-changing, rewarding, stressful and outright ‘WFT’ experiences!

But before I get into this blog post, I think I owe you an explanation for not posting on this platform and yes, being MIA . As a content creator, I somehow find myself cringing whenever creators preach and speak about being ‘consistent’. Let’s be real, consistency is honestly not an easy skill/habit to nurture and maintain, but alas very important, especially if you want to achieve big results.

So, why have I been MIA?

My honest response, I’ve been preoccupied with writing and creating content for clients and my other platforms – YouTube, Podcast and social media platforms like TikTok (which is a good thing) but unfortunately I neglected this one. I’ve also been busy trying to juggle and manage the many projects and/or activities on my plate that I did not have enough hours in a day to squeeze in blogging. Somehow, I feel like this is not a good enough reason, but it is true. I suppose I also need to leverage technology like artificial intelligence (AI) to be more efficient, but that’s a story for another blog post.

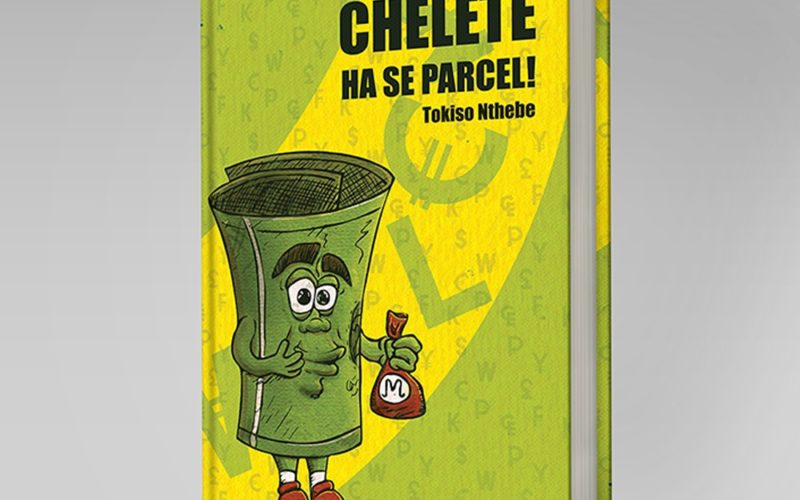

In a previous blog post, I shared several issues I’ve struggled with since leaving my corporate job. What I have not come clean about, however, is the struggles and challenges I’ve experienced with managing my finances and navigating life as a freelancer and/or someone who is self-employed. Despite my finance background, the type of content I create around managing our finances and actually having a plan prior to resigning; a big misconception some people have is that because I openly talk about money means that I do not have challenges or struggles to manage mine.

This could not be further from the truth!!!

The last two years have been a rollercoaster ride, FINANCIALLY. Transitioning from a decade-long chapter of a stable salary, 13th cheques and performance bonuses has been no small feat. For as long as I can remember, my lifestyle and financial plan centered around the 20th day of the month, from my investment and insurance debit orders, loan repayments for my house, credit cards and other subscriptions. I planned excursions and trips knowing that my income is ‘guaranteed’ and will be paid on time.

Though I had planned thoroughly before quitting my corporate, the turbulence of adjusting to the new chapter has been rough.

Submitting invoices vs. getting paid

The first adjustment and lesson learnt are without a doubt making peace with ‘submitting invoices vs. getting paid’. Coming from an era where I was certain that I would be paid on the 20th of every month, transitioning to an era where you do the work, submit an invoice and deal with the uncertainty of being paid is an extreme sport. As a finance coach, I should know better than to ‘budget’ money that is not in my bank account. A BIG mistake! Secondly, I should sign contracts with clear payment terms and penalty clauses, have savings to cater for such delays, forecast and plan right? Which I have…But what happens when you’ve rampantly run through your savings because invoices aren’t paid on time despite doing things right and planning ahead? Or you get responses such as ‘We forgot to submit your invoice to finance for payment?’

How to price for services/goods

Being The Finance Bachelor who should have ‘everything figured out somehow‘ I almost feel ashamed opening up about this. Leaving my corporate job to pursue my passion also came with many uncomfortable experiences especially when setting prices and negotiating with clients. Granted, I know my worth and the value I contribute, but there’s also a very intricate balance one needs to manage between being too confident (or sometimes deemed as arrogant) and desperate. The first few months were particularly challenging when I gave clients my rate card often asking myself ‘Did I over or under charge?’ ‘Am I charging correctly for this type of service?’ ‘Am I pricing from a desperate base?’

Despite the fact that I do research before determining prices, I believe we do not have enough conversations about how crippling sending a quote is, hoping the client accepts it especially when the rent and other living expenses are due in a few days – it kinda makes you a little desperate. The cycle is vicious! The trauma that comes with a quote that is declined and/or rejected because you are very ‘expensive’ relative to other service providers often leaves one scared. Furthermore, the pressure to often compromise, and lower your fees (knowing that it’s going to cost you in the long run) just to maintain the relationship is painful. Let’s not forget about the other dynamics we encounter, particularly in Lesotho a small market where most people know each other. Sadly, it takes time to develop a thick skin and stay the course. A journey I’ve embarked on over the last few months.

So, how am I actually navigating my finances?

Let me end this blog post here for now and continue with the story in part 2 coming next.

Love, light and money!

Comments 1